Feel free to get acquainted

What is sustainable investing?

If you want to take the interests of future generations into account when investing, you presumably also will consider sustainable investing. More so than regular investments, sustainable investments are assessed critically for their environmental, social and (corporate) governance characteristics (ESG). As the name suggests, a 'sustainable' company must have a long term orientation and ensure that it can continue to operate profitably many years from now.

Sustainable investments must meet certain requirements: it's an investment in an activity that contributes to an environmental and/or social objective, that does not harm other environmental and/or social objectives and where the investee company meets minimum governance standards. If not, they cannot be invested in within a sustainable investment strategy. Consider the exclusion (sale) of a share of a company that has committed an environmental crime, been convicted of bribery or that does not treat its staff well according to official agencies. Whole business sectors can also be excluded, such as tobacco, alcohol and gambling companies, adult entertainment, arms manufacturers or 'fossil' energy companies. Also, an investment that initially did meet certain requirements may later be excluded, based on new information or after an incident.

Environmental, social & governance: ESG

Many publications on sustainability use the terms environmental, social and governance, or ESG for short. The E stands for nature and environment, the S for people & society and the G for good (corporate) governance. The term ESG also appears regularly in European legislation. For example, in the Sustainable Finance Disclosure Regulation (SFDR) of the European Union. This is an important regulation relating to the disclosure of sustainability information in the financial sector. It is part of the European Commission's Action Plan to finance sustainable growth. For example, the SFDR defines, among other aspects, the criteria that must be met for an investment to be called ‘sustainable’.

The method chosen depends on the portfolio manager's sustainability goals and investment approach.

What is the difference between sustainable and responsible investing?

'Sustainable investing' goes beyond applying fundamental standards, where sustainability analysis can be used as a tool to achieve better investment performance and align your portfolio with your interests. Sustainability analysis is the testing of the behavior and a wide range of ESG characteristics of a company (or issuer). At InsingerGilissen, clients can choose either a ‘sustainable’ or a ‘responsible’ form of Discretionary Portfolio Management, among other options.

3 sustainability ratings: gray, light green, dark green

De Europese Commissie heeft in de SFDR bepaald dat beleggingsproducten in drie categorieën duurzaamheid zijn onder te verdelen. In Europa hebben beleggers daardoor de keuze uit artikel 6- (‘grijze’), artikel 8- (‘lichtgroene’) en artikel 9- (‘donkergroene’) fondsen, genoemd naar wetartikelen waar zij in staan omschreven. Artikel 9-fondsen hebben een duurzaam beleggingsdoel: dat is de groenste categorie. Lichtgroene fondsen, oftewel artikel 8-fondsen, moeten ecologische en sociale kenmerken promoten. Deze fondsen mogen zich committeren aan een deel duurzame beleggingen, maar dit hoeft niet. En de minst duurzame categorie, de grijze (artikel 6-) fondsen) hoeven alleen te analyseren welke duurzaamheidsrisico’s ze lopen. Hoe groener een fonds claimt te zijn, hoe meer informatie het moet publiceren om die claim te staven. Alleen vooraf gepubliceerde doelstellingen mag ook daadwerkelijk over worden gerapporteerd. Eén van de doelstellingen van de SFDR-classificatie is dat fondsen zich niet groener voordoen dan ze werkelijk zijn, zodat de consument een heldere keuze heeft.

On what criteria can sustainable investments be selected?

When constructing the investment portfolio, the portfolio manager can select investments on both ESG and financial characteristics. There are many different ways of selecting on ESG characteristics, not all of which we apply at InsingerGilissen. The method chosen, which can also be a combination of methods, depends on the portfolio manager's sustainability goals and the investment approach.

Some common selection methods include:

- Best-in-class approach: the fund or portfolio manager observes which companies or institutions score best on ESG characteristics and constructs a portfolio with investments that score among the top 50% or top 20%, for example.

- Negative screening/exclusion: investments with serious issues, for example if a company is linked to cartel conduct, or convicted of environmental crimes, bribery or child labor, are excluded from inclusion in the portfolio. Negative screening can also mean that an investment that is part of the portfolio, is removed from it, due to an event or other new information.

- Impact investing: only those investments are selected that have a clear and measurable positive impact on ESG characteristics. Examples are investment in a water treatment plant, investment in a renewable energy project or a factory that produces filters to render greenhouse gases harmless.

- Theme-based investing: this involves selecting investments related to a specific theme, for example hydrogen technology. In the latter case, consider manufacturers of the catalysts needed for hydrogen engines, hydrogen storage, manufacturers of hydrogen-powered vehicles and so on.

- Engagement: this is not strictly speaking a selection criterion but a way of investing, in which the shareholder or portfolio manager actively engages with the managements of the companies or institutions invested in or from which bonds are purchased. Voting at shareholders' meetings can also be part of the approach. The aim of these discussions and voting at shareholders' meetings is to induce the management concerned to commit to (even) more sustainably. Themes and criteria include working conditions and terms of employment, efficient use of raw materials and ecological footprint, co-responsibility for sustainability characteristics at suppliers and customers ('chain responsibility'), respect for human rights and the way in which a company is governed (such as diversity within the management and attitudes towards employee representation and trade unions).

In which companies does InsingerGilissen invest?

When investing directly in a company’s stocks or bonds, the company must meet our ecological and social conditions. Otherwise, the stocks and bonds can’t be included in the portfolio an InsingerGilissen investment fund or the investment portfolio of a Discretionary Portfolio Management client. In addition, specific companies are included in our portfolios that contribute to an ecological or social goal. This can be for example: alignment with the Sustainable Development Goals of the UN, a good performance in terms of CO2 reduction or the fact that the company is involved in education or health care.

How sustainable are InsingerGilissen's investments?

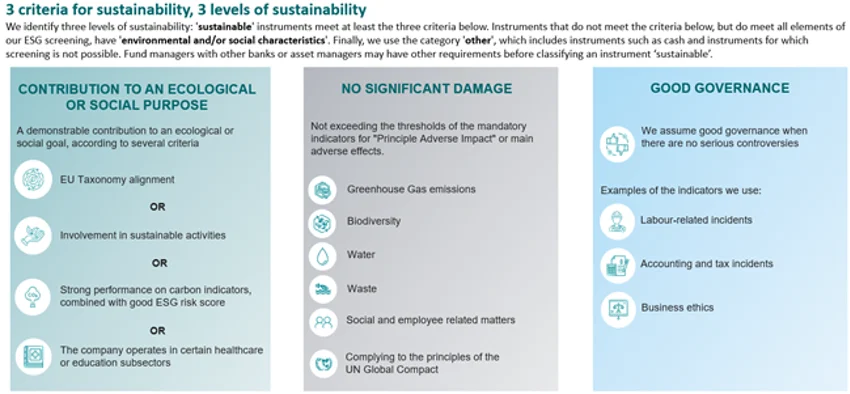

For our investment services Discretionary Portfolio Management and Investment Advice and in the selection of investments for our investment funds, we distinguish three levels of sustainability. 'Sustainable' instruments meet at least three criteria: contribute to an ecological or social goal, do not detract from it, and good corporate governance practices must be the case. The criteria can be seen below in a diagram.

Instruments that do not meet the criteria below, but do meet all the elements of our ESG screening, have 'ecological and/or social characteristics', the second level. Finally, we use the category 'other'. This includes instruments such as cash and instruments for which screening is not possible. Fund managers from other banks or asset managers may have different requirements before they classify an instrument (such as a mutual fund) as 'sustainable'. This is why we investigate ‘sustainable’ funds from other managers thoroughly, before investing in them.

How do we screen for ESG characteristics at InsingerGilissen?

In selecting investments for a sustainable investment portfolio, we apply several principles, two of which we highlight here. As mentioned, we screen for environmental, social and corporate governance (ESG) characteristics. To do this efficiently, we purchase ESG data on companies from reputable, independent sustainability data providers, including Morningstar Sustainalytics (‘Sustainalytics’). Based on point scores on some 190 different company characteristics, we give each assessed company a ranking on ESG elements, awarding up to five stars, based on a best-in-class approach. This means that we rate all companies on their sustainability characteristics, compared to other companies in the same (sub)sector or industry.

Minimum requirements and exclusions

But a minimum percentage of sustainable investments are also included, that goes without saying. The objective of the ‘sustainable’ version of our asset management strategies is, that at least 20% of the investments in the portfolio are sustainable according to our standards and that the remaining part of the investments meet our environmental and social conditions.

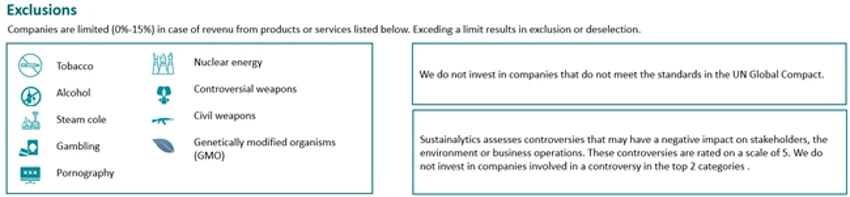

Excluded from inclusion in our sustainable portfolios and investment strategies are all investments that do not meet the requirements of the UN Global Compact. We also exclude investments in companies with more than 15% revenue from tobacco, alcohol, adult entertainment, thermal coal, controversial weapons (such as cluster munitions), civilian weapons, gambling, nuclear energy and genetically modified organisms.

What are the sustainability features of InsingerGilissen itself?

Not only do we consider ESG factors when selecting investments, we also do so in our own operations. Indeed, we see sustainability as a core value in our business and as a driver of investment performance. So we place sustainability at the heart of everything we do. For example, when investing for our investment funds or our clients' portfolios, we fulfill the role of active shareholders (engaged co-owners) because we believe that when companies are sustainable, they become better companies. That benefits investors, society and the planet. In the long run, that also produces returns for ourselves. A sustainable return, so to speak. You can read more about our sustainable business practices in our Corporate Sustainability Report. And on this page you can learn more about how we make sustainability central to our services and investment approach.

The sustainability features of our mutual funds

We regularly report on the sustainability characteristics of our investment funds. The way we do this is prescribed by European regulations, the SFDR. If you are interested in this, please visit our formal sustainability information page.

An award-winning private bank

InsingerGilissen is a Dutch private bank and part of the European Quintet group of private banks. Both InsingerGilissen and Quintet have received multiple awards for their investment performance and services. Quintet was also named one of the world's best banks in terms of sustainability and ESG leadership in 2022. We are quite proud of that. See also Embracing sustainability in our practices

Our returns on sustainable investments

Although many people in the Netherlands do not yet know it, a large body of scientific research shows that sustainable investing produces returns that are as good as, or better than, regular investing. More than a thousand studies, including Morningstar's, confirm this. Many sustainable investors will also argue that their investments do not come at the expense of nature and society as much, if at all, and that these non-financial returns also represent value. Of course, past performance is no guarantee for future results. Are you curious about the returns of our sustainable investment strategies? You can find them on independent websites such as Finner.

How to begin with sustainable investing

Starting with Sustainable investing can be done in many ways. If you have a million euros or more in freely investable assets, we would welcome you as a client and you can opt for our Discretionary Portfolio Management (DPM) or our Investment Advice. We offer DPM in the ‘Bewust’ (Aware) variant, among others. In addition, you can also opt for our Future+ mandate. This is a DPM strategy that combines financial returns with a strong focus on sustainability. In our Investment Advice service, we can advise you on the sustainability of investments.

Our commitment to people, planet, society and good corporate governance

We take our social responsibility very seriously. We would prefer to leave the earth better than we found it. Thanks to the motivation of our employees and our presence in various European countries and cities, we have a unique opportunity to make a difference as a responsible corporate citizen in the local communities in which we operate. This includes spending time and money on good causes and supporting important initiatives, so that we contribute positively to social change. Want to learn more about our sustainability initiatives?

Get in touch

Are you looking for a private bank that is more than a bank? And that first has a profound conversation with you before producing an investment proposal? We assist our clients and the generations after them in making important financial decisions at every stage of their lives. And where possible (and desired, of course) we take care of your financial administration and other chores. Thanks to our offices in Amsterdam, Rotterdam, The Hague, Groningen, Zwolle and Eindhoven, there is always a Client Advisor close by, who you can talk to. Of course you can also reach us by email and phone.